Actualités

Conférence publique sur le rôle de la société civile entre l’île de la Tortue et la Palestine

Le vendredi 19 avril à partir de 18h, la chercheure Nadia Abu-Zahra (Université d’Ottawa) donnera une conférence sur les mythes et les réalités de l’aide humanitaire et de l’aide au développement du Canada vers la Palestine. Alternatives invite le gran

Par la présente, vous êtes invités à l’assemblée générale annuelle, qui aura lieu le samedi 20 avril 2024, à partir de 9 h 30 dans les bureaux d’Alternatives situés au 3720 avenue du Parc à Montréal. Afin de faciliter l’organisation de cet événement, n

Alternatives en entrevue à l’émission Les aurores Montréal de la radio CIBL

Alternatives à CIBL 101.5 FM – Les aurores Montréal – Le Programme de stages internationaux pour les jeunes Jérémy Bouchez, agent des communications, et Kasandra Boisvert, chargée de projet, recherche de financement, étaient en entrevue à l’émis

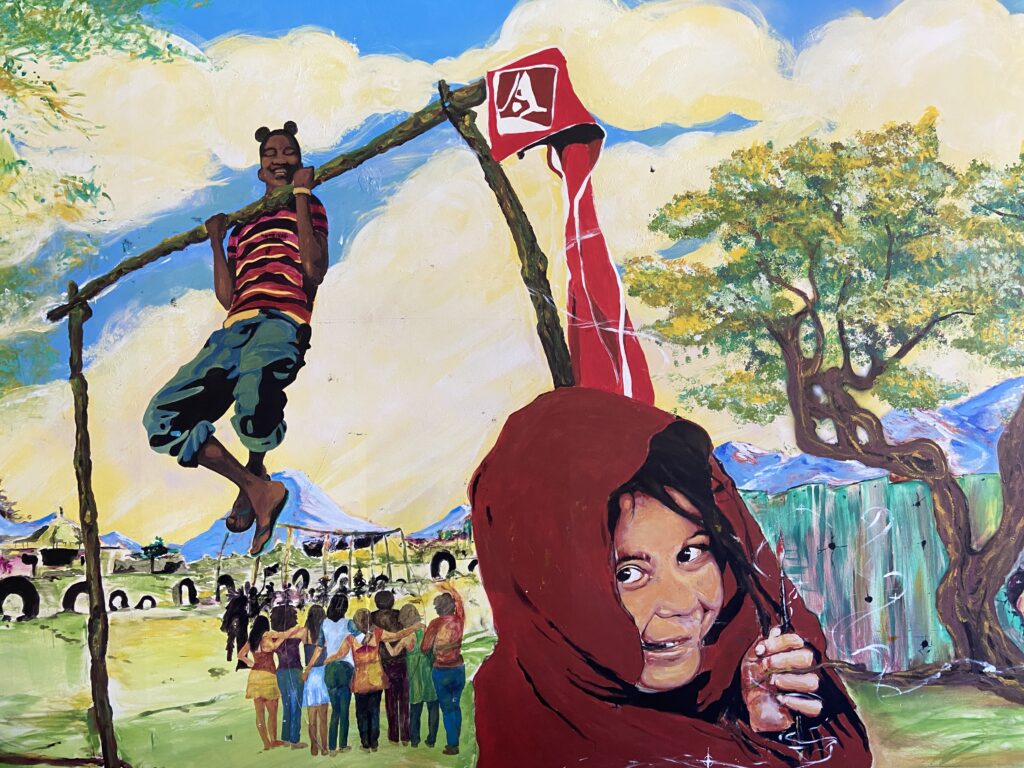

C’est parti ! Lancement du Programme de stages internationaux pour les jeunes (PSIJ) 2024-2029

Bienvenue dans la page principale du Programme de stages internationaux pour les jeunes d’Alternatives! Objectifs Dans la continuité des nombreuses initiatives que nous avons menées auprès des jeunes au Québec et au Canada au cours des trente de

Nos publications

Alternatives International Journal (AIJ) est un bulletin électronique sur l’actualité internationale en langue anglaise, diffusé par la fédération Alternatives International qui rejoint mensuellement environ cinq mille abonnés.